Investing is damn hard, and I can’t say I’m good at it (at least just yet).

Some people, however, are pretty successful at it. And they share one secret: they invest at the frontier.

My partner in crime Chris edited this chapter of Unbeaten Path with the help North London’s oddest solo artist.

"Software is eating the world" is one of the most iconic pieces of writing of the last two decades - at least in our bubble.

To me, the most important part of the essay is:

Why is this happening now?

Six decades into the computer revolution, four decades since the invention of the microprocessor, and two decades into the rise of the modern Internet, all of the technology required to transform industries through software finally works and can be widely delivered at a global scale.

What Marc Andreessen understood in 2010 was that two trends - an increase in computing power and the availability of an internet connection - created the perfect conditions for the previously impossible, to thrive.

Investors typically breeze past the "Why Now" part of a startup pitch, but it is exactly from the Why Now that we can understand how the world will look in the next few years.

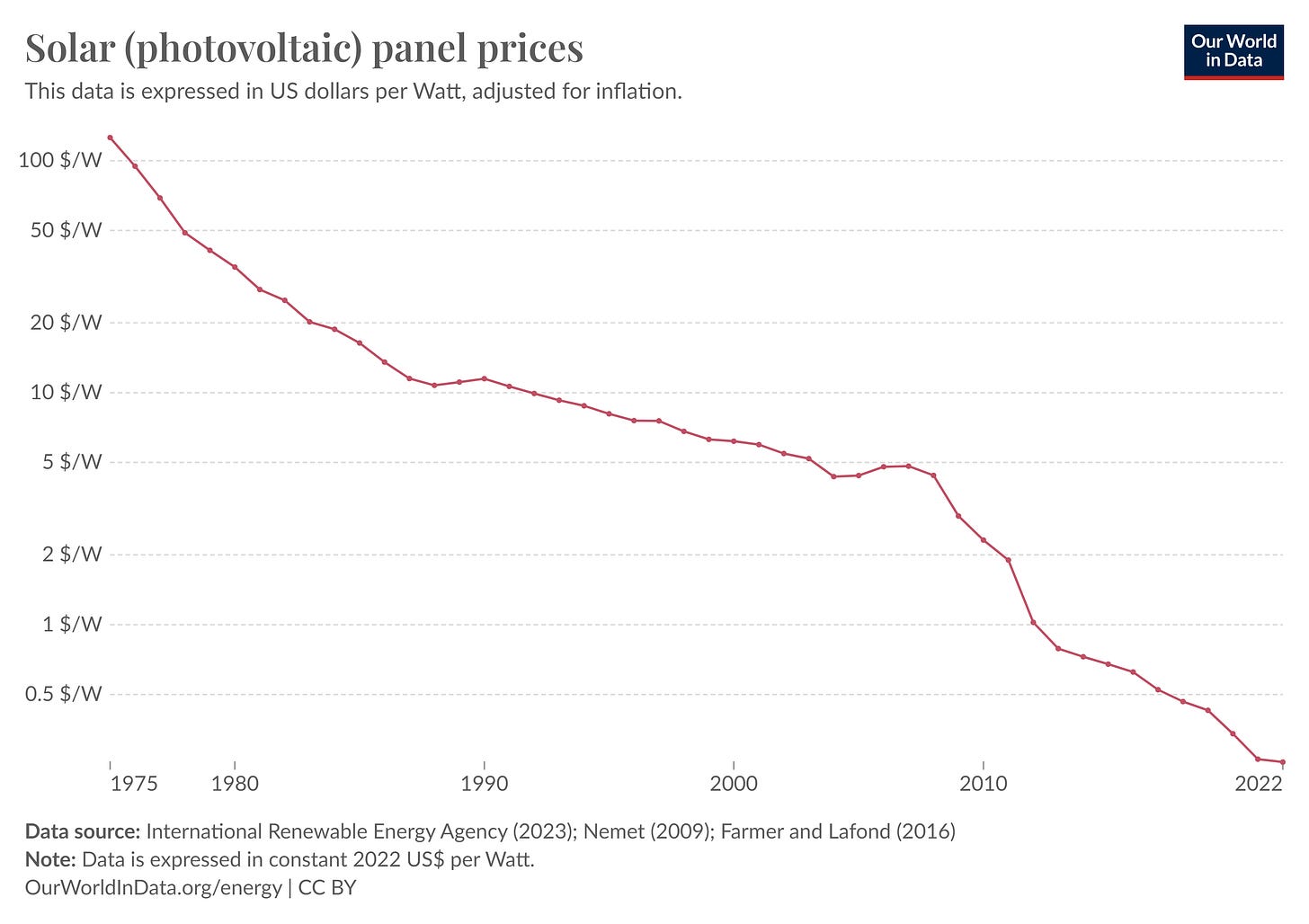

Look at this graph:

What the hell happened in 2016?

Simple. SpaceX began reusing its boosters for commercial flights.

Thanks to this technological breakthrough, SpaceX has launched 6,551 Starlink satellites starting May 2019. That’s more than 1,300 per year, or one roughly every seven hours.

Take your mind back to 2015 before the boom in the previous graph. Apple has just launched its first wearable, and Instagram has just become bigger than Twitter.

You are sitting in front of a founder who tells you they will send 1,300 satellites into orbit. Every year. You are a diligent investor so you check your numbers, and find out that IN THE WHOLE WORLD just 222 objects were launched into space in 2015.

You laugh and pass on the investment.

Congrats, you just lost a huge amount of money. And that’s because you didn’t stop to think "Why now?".

Keep an eye on the trends

Now you might say: of course Elon Musk knew that the cost of space launches was trending down, because he was building those reusable rockets himself. And Andreessen clearly had a privileged point of view on the evolution of the internet, having helped to build it at Netscape.

That is true, but the world has changed.

Today we have people like the amazing folks at ourworldindata.org, who produce pages like this. Literally by clicking a link, you can now learn that sequencing a full human genome in 2024 is 200,000 times cheaper than it was in 2001.

Or that in the same amount of time, the price of solar panels decreased 24x.

There are literally dozens of downward-trending (or upward-trending, for what it matters) graphs like this.

Which applications were impossible yesterday, but will be ubiquitous tomorrow?

Each of these graphs merits its own post, but my point is broader.

Explore the frontier

Investing at the frontier is hard, but it’s worth it. The frontier informs us how the world will look in the next 10 years.

There is one thing I always try to remember during my day job: VCs, especially those in deep tech, invest in a vision of the world 10 years from now, not tomorrow’s world.

And if this is true, the only way I know to "predict" the future is to study technologies, observe the trends, try to guess where the tide is going, hoping to be lucky and guessing right.

The technologies at the frontier can be dominated by hardware (very often) or software (less often), but they all share one characteristic: if they work, the impact they have is exponential.

We are not talking about 10% cheaper or 10% faster, we are talking about things that would make absolutely no economical sense yesterday and are a no-brainer today.

That is the power of exponentials.

Great post Francesco, and great resources!

Well said, good point of view!!