I don’t like social networks, and I like them even less now that basically every other post is AI generated. How does our daily job changes when intelligence is a commodity and old tactics don’t work anymore?

My buddy Chris edited today's Unbeaten Path from the Catalan capital, Barcelona, where it's Sant Jordi - a day where locals give their loved ones a rose or a book.

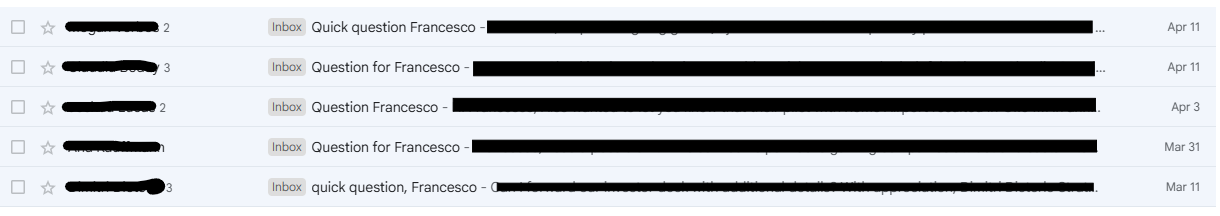

What are the chances all these people chose the same subject line for their cold outreach? AI outreach is clearly out of control here.

Leaving my irritated-VC comments aside, this made me think: what’s more important, the magnitude of your intelligence, or the delta between your intelligence and your competitor’s?

This is somewhat the same question that is at the core of the controversial Enhanced Games - privately-owned event that's inspired by the Olympic games but doping is accepted: if each athlete is doping, then it’s like if none of them took drugs. In other words, performance enhancing drugs increases the magnitude of the performance, but the delta doesn’t change.

To rephrase this in more generic terms: in a world in which intelligence is commodity - there are almost one million LLMs on Hugging Face - how can it be a differentiating factor by itself?

Sure, there will be some transition period in which the magnitude of intelligence will make a difference, and those that use AI will outpace or outwork those that don’t. But at steady state, it's the delta that's the difference maker, not the magnitude: while the magnitude of intelligence is artificially increased by AI, it's how well you apply that intelligence on the ground, the little things you know that others don’t, that makes a difference.

I believe this applies both to company building and to venture investing.

Back when building a data-driven strategy was a job for specialists, having a smart scraper that could get the right signals from the web might have been a competitive advantage. Today, at least from my experience, it won’t make a difference.

Anecdotally, a few of my portfolio founders were highlighted by data-driven VC platforms and were flooded by messages. They prioritized replies exactly how you would expect: brand and connections.

This brings me to an important point: in a world where intelligence is a commodity, it's brand and connections that will make a difference between out-of-distribution and average performance in venture investing.

Brand has always been important in venture. There is this feeling in this industry that certain people/funds are the hidden hand, a kind of King Midas of VC, and whatever they associate their brand with becomes the next big thing.

The best way to escape this has been for a long time to invest in small pockets of the market where deals are illegible to most - either because they emerge from a little understood geography, the topic is highly technical, or the stage is extremely early (oftentimes before the company even exists). If you did this well, you could pick a few winners and rise to become the kingmaker. This is, for example, the story of Hummingbird - “The best venture firm you’ve never heard of” - that is now a household name and its presence in a deals signals quality and exclusivity.

With intelligence increasing in magnitude, however, it is sufficient to change your LinkedIn bio with “Stealth” to be contacted by dozens of investors. There still are very illegible deals, but have become very rare and it’s probably hard to find pockets of the market that are still undiscovered.

This is where branding and storytelling come into play.

Are you top of mind for founders and other investors for what you do? Do people know what you think, and is it easy for them to identify the deals you are interested in? What are you doing to build such a brand?

These are all questions investors should ask themselves, as those that don’t will end up underperforming. This is also one of the reasons I write here: despite having a small audience, every piece I write gets me connections with like-minded people, and helps me build a brand that people recognize.

The need for connections is also nothing new, but the way networking works is changing fast.

As AI eventually kills outbound as a channel, networks will become all-important.

The scale of outbound sales will increase by orders of magnitude and the well will become permanently poisoned. Your bot’s emails and calls will just go unanswered. Your AI generated SEO blog posts will go unread. Your personalized video won’t feel special.

There will be infinite, undifferentiated competition for every opportunity and so those direct with access to wide or specialized networks of buyers, talent, knowledge, etc. will become valuable gatekeepers. Distribution will be everything.

Sometimes this job feels very transactional, and are those people that are able to build a real personal connection that will stick in my mind. Those people do little things in an exceptional way - they remember your kid's name, for example, or they recall you were sick last time and check in on you.

Creating strong personal connections is a superpower, that in an age of AI-powered noise becomes a differentiating factor. Digital social networks are dying under the choking weight of AI, and physical social network - the real human connections - are going to be a competitive advantages.

A second-order effect of physical social networks is that they are constrained in size by definition, as it’s impossible to keep in touch and build real connections with too many people. This makes specialization even more important, especially at the early-stages. If you want to build a network of people that deeply understand the space, that provides a competitive edge, you have to use your time wisely and spend it in the right places. Do you invest in highly technical topics? Then it’s probably better you spend your time at academic conferences rather than giga-events that favor quantity over quality.

This is a great opportunity for those early-stage investors that are willing to put in the work, willing to specialize and take risks others are not willing to take. Maybe this is the reason why there are many first-time managers targeting very specific thesis and not going wide but going deep.

I think this is the right way to go.

Hello Francesco,

I hope this communique finds you in a moment of stillness.

Have huge respect for your work and reflective pieces.

We’ve just opened the first door of something we’ve been quietly handcrafting for years—

A work not meant for everyone or mass-markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where conciousness, truth and judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, vision, patience, resilience and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral.

But it’s a multi-sensory experience and built to last.

And, if it speaks to something you’ve always known but rarely seen heartily expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to experience it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.