Europe’s path to avoid becoming a geopolitical footnote

#31 | On what can Europe do to take advantage of current US vs China cold war

In Italian, we have a proverb that goes: “Tra i due litiganti, il terzo gode,” which loosely translates to “When two dogs fight for a bone, a third runs away with it.”

I can’t help thinking about this proverb when I look at what’s happening recently between the US and China, thinking about the opportunity that lies ahead of us as Europeans.

This is a long post, but one that means a lot to me and should also mean a lot to you if you’re European.

Enjoy!

My buddy Chris edited this edition of Unbeaten Path after closely following his friend's (and ex-colleague's) coverage of the MAGA meltdown over Jeffrey Epstein. You can sign up for Tara Palmeri's Substack here.

Europe has a huge storytelling problem.

Some might argue storytelling doesn’t matter because there’s a difference between what people say and reality. However, this is the short-attention-span era: we've outsourced critical thinking to algorithms, owned by the US or China, and therefore we simply tend to believe what people claim is the current state of things.

I see this dynamic every day in my VC job, and I’m seeing it play out in the latest iteration of the US vs China debate.

The fact that I’m referring to it as “US vs China” says it all: where the hell is Europe in all of this?

I’ve read dozens of articles and listened to even more podcasts that discuss the levers the US should pull to regain a position of strength or analyze why China will be the dominant power of the next century.

Unfortunately, I haven’t come across a single piece discussing what Europe’s role is in this and how Europe could regain strategic relevance in this fight between the two giants.

So, I decided to write that piece.

What follows is my attempt to paint an optimistic picture – but always grounded on truth - of what I believe is the state of things and why Europe has a chance to play to its strengths to regain relevance.

The US needs China

The first thing to notice, which not many American opinionists like to admit, is that the US needs China.

What's very clear by now is that the US has become an economy driven by financial dominance, and it has 36 trillion reasons why this can't change.

The modern US has been defined by the dominance of the dollar as the exchange currency of choice for global trade. This has generated infinite demand for US treasury bonds, which in turn provided never-ending fuel to internal consumption.

What happens when the well-oiled system of global trade encounters additional friction? Markets know the answer very well and reacted accordingly when Trump imposed his tariffs.

The US needs a trade deficit because they need to release US dollars for countries to buy their debt. This is the case for most countries and especially so when talking about China as the US accounts for around 15% of Chinese exports. How do you replace that?

Moreover, most of the value US companies create today is through their contribution at the top of the value chain – their IP, their designs, and their distribution networks.

They need a manufacturing partner to put their IP in the hands of their end customers. Hello “designed in Cupertino, manufactured in China”.

The way global trade is organized today works very well for American companies: Nvidia and Apple wouldn’t be worth what they’re worth if it wasn’t for the extreme efficiency of specialized manufacturing in places such as China and Taiwan. Big tech can afford to spend $100Ms to poach the best brains from the competition because global trade allows them to monetize on the IP those brains will generate.

The Trump administration wants to increase the cost of producing abroad by imposing tariffs but, as discussed above, you can’t have your cake and eat it too – increasing friction on global trade increases the cost to finance their national debt, which by now is so big that it can bankrupt the country.

To add complexity, China controls the supply chain of many of the basic raw materials that define the technologies of the future. As much as Americans try to play hardball, they know they can’t get around many of those monopolies overnight. China obviously knows that as well and has already used this weapon in the latest negotiations over tariffs.

While it’s not easy to say if and how the US will be able to decouple from China, it’s clear that it will take time and be very painful.

China needs the US

From all of this it might sound like China has already won, and it’s tempting to think so, but that’s not the full reality of things either.

In fact, China needs the US, too.

People in the Western world are beginning to experience the benefits of moving up the value chain, as they drive Chinese cars, purchase Chinese smartphones, and record videos using Chinese drones.

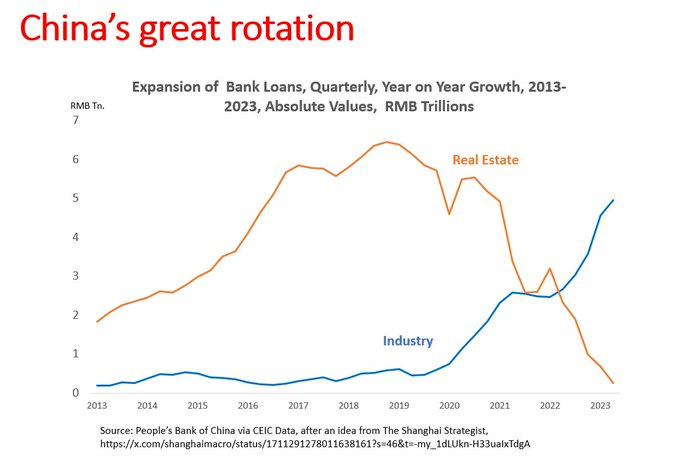

We shouldn’t be surprised that we are starting to see Chinese high-tech products entering our lives, as it is the result of a shift in public spending from real estate to industry after the real estate crisis of 2020.

When companies are paid to produce more, they will produce more even if that means producing more than their market can absorb. This creates downward pressure on prices and saturates internal markets – without export, this system collapses.

Without the relief valve of export, Chinese producers will have to look even more at the internal market. This is very risky for the Chinese economy, because too much supply and not enough demand create deflation, which is the nightmare of economists because there are no effective economic measures to defeat it.

We are used to thinking that the Chinese economy is mostly focused on export - and they export a lot, of course – but what remains often untold is that, as a percentage of their GDP, they don’t export that much.

They are a big country and don’t really export that much compared to what they produce. Despite this, the rest of the world feels overwhelmed by Chinese goods.

This is why they need the US: they need someone to sell their goods to.

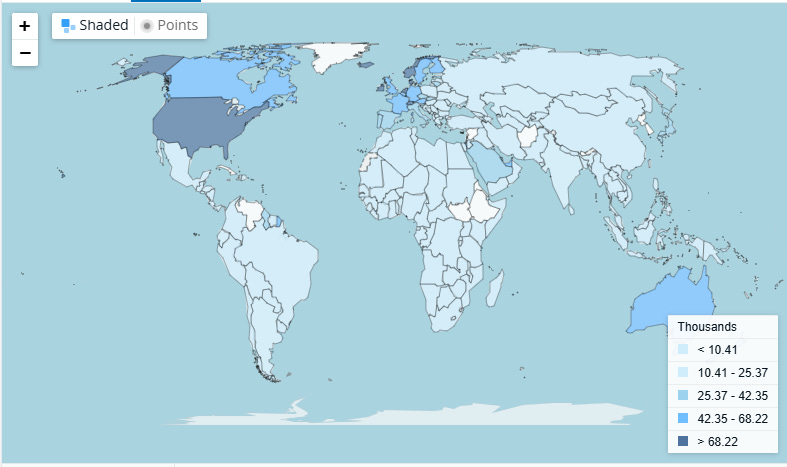

China obviously knows this, and in the last years has tried diversifying their export markets with programs such as the Belt and Road Initiative and the investments in Africa. But looking at GDP per capita in the world, it’s clear that the US are hard to replace:

Who’s going to spend as much as Americans do? Hardly anyone.

Arrived at this point, it is clear how complex and high-stakes the current US vs China debate is and why those trying to simplify it into slogans are not painting the full picture.

Europe needs both the US and China. Or does it?

So, where is Europe in all of this?

We are starting from a weak position, and it’s all because of fragmentation.

Fragmented capital markets don’t have enough scale to support big companies and to attract foreign investments; fragmented bureaucracy creates internal barriers that look very much like tariffs, and fragmented defense makes us spend money slowly and inefficiently when what we need is strength and deterrence.

This means that we can’t attempt financial dominance like the US, we can’t grow European champions that can win internationally like in China, and we can’t impose our military power like the US and China.

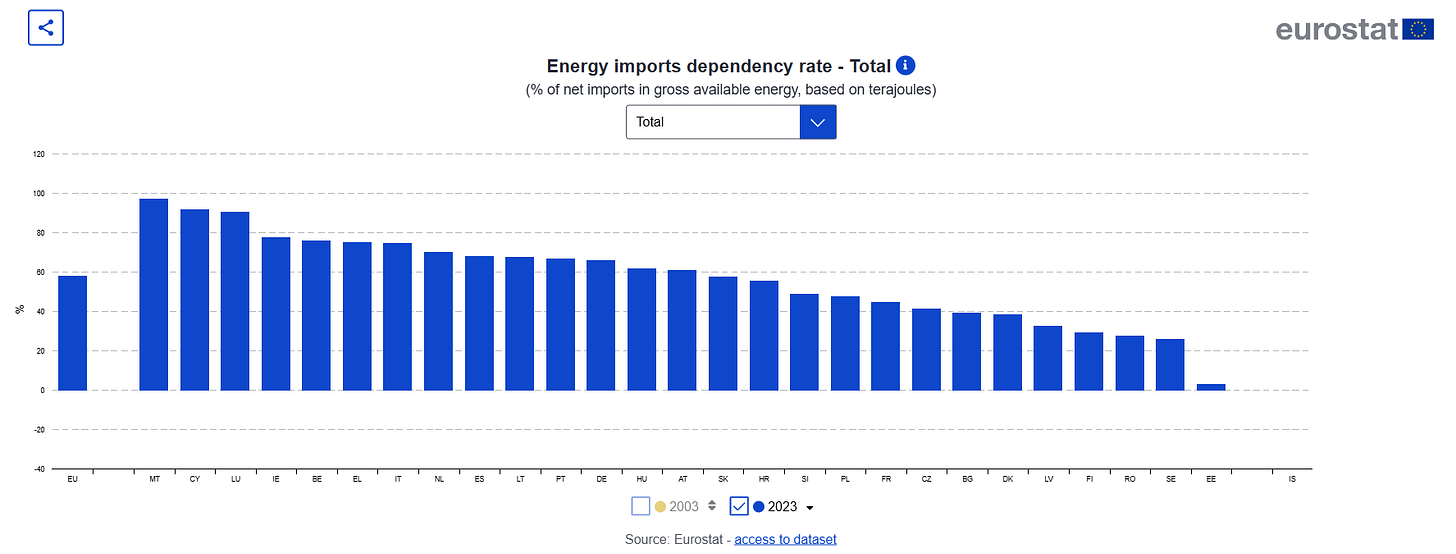

Moreover, we are not energy independent, thus being susceptible to external shocks that we can’t control - such as a crazy guy invading a neighboring free country.

Looking at the glass half-full, starting from a weak position means that we don’t have a strong position to defend in this real-world Risk game. We have seen that the main challenge China and the US are facing is to solve their problems without breaking what already works. We don’t have this “problem”.

Being a first mover works great when it works, but it means you have to face uncertainties without a working playbook to rely on. The US and China have been first-movers with their own strategies, Europe is today a follower: we can look at what worked and what didn’t work and try not to commit the same errors.

The most pressing thing to fix in Europe (leaving bureaucracy aside) is energy, as “everything is downstream of energy”.

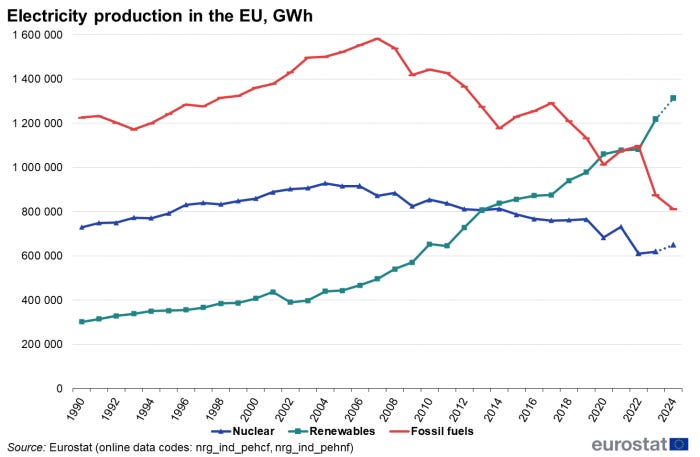

Not many know that today Europe produces more electricity from renewables than from fossil fuels.

The beauty of renewables for Europe is that we still play an important role in the value chain of wind and hydroelectric power. Moreover, while most of the solar industry is concentrated in China, it is mostly the result of the difference in investments between Europe and China - 10x less in the last decade - and there is nothing structural that cannot be reverted (apart from a few selected raw materials). This is a big difference from fossil fuels, that will always be constrained by the availability of the raw materials in a given region.

Electrifying our economies can reduce our dependency on oil-producing countries, many of which have unstable or openly hostile governments, finally making obsolete fossil fuel supremacy and achieving strategic independence. This should be a major geopolitical goal for our continent.

The other important thing to notice is that complete decoupling of modern economies is impossible to achieve, and it is delusional to think of a future in which the US or Europe or China will produce all they consume on their own.

If this is true, then what is it that we do want to reshore and own?

Things that have high value added, that employ skilled people in interesting jobs, and that are in the supply chain of the most critical industries.

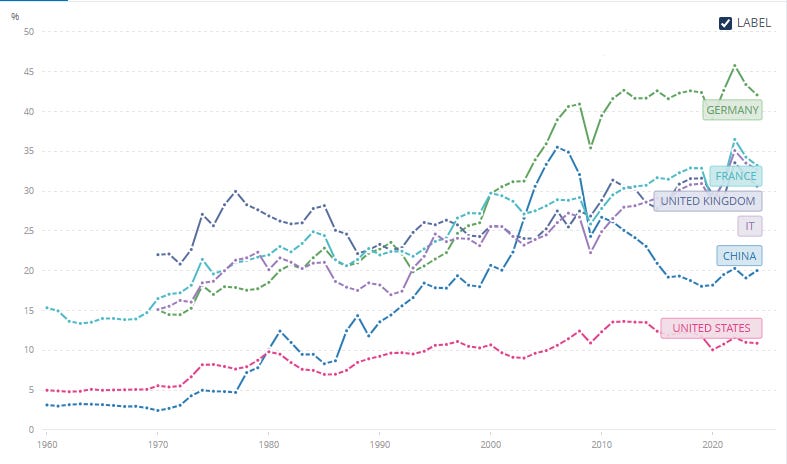

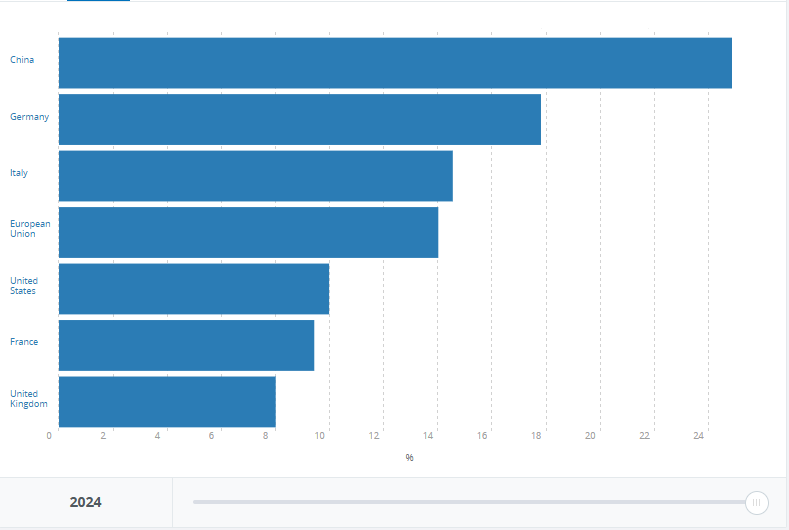

As it turns out, in Europe, we still have much of that. Despite the talk of the town being how the only industry we have here is that of bureaucracy, the reality is that European countries are still leaders in the manufacturing of industrial tools that are essential for precision engineering, pharma, and semiconductors.

We still are a manufacturing-heavy economy, and we should always remember that when talking about “reindustrialization”.

Precision machinery is essential for the future of industry: a future in which energy usage comes mostly in the form of electricity, creating a natural ecosystem for software-defined manufacturing to thrive and for the virtuous data feedback loop, the loop that made internet companies great, to kick in.

Sure, software will play an increasingly important role. But at the core of everything is the ability to build high-quality physical things with sustainable marginal costs, something that is not true in the internet world and that economies can’t relearn overnight. Something that, despite everything, Europe is still quite good at doing.

One of our main weaknesses is having almost completely missed the internet revolution, as exemplified by all those memes comparing the market cap of the Mag-7 with that of entire national public markets.

But that is also a trap for the US, as those companies have built their brand on software but built their moat with hardware, often not built in the US.

It’s a familiar pattern: railroads needed land, cloud computing needed fiber, and now AI infrastructure needs vast, stable power. In the exponential age where compute demand outpaces supply, owning tomorrow’s terawatts may matter more than having the smartest model.

Azeem Azhar on Linkedin

If this is true, and if Europe is ambitious enough to remove the artificial blockers that bureaucracy and fragmentation have imposed on our economies, why should we accept a subpar role in the new world order?

Why shall we still accept to be the supporting leg of the empires of yesterday or of those of tomorrow?

I don’t think we should, and people are starting to realize that.